Written by Shomik Dutta and Teddy Gold

Higher Ground Labs is embracing the future of sustainable impact investing.

Equity investing in political tech is challenging and may require re-imagination.

For most political tech endeavors, venture-scale returns are an unobtainable fantasy. We see hard ceilings on exit possibilities for most of our companies because there are not many acquirers and those acquirers don’t have endless balance sheets. Equity follow-on investments therefore face an unsavory trade-off: a founder must either convince investors to accept impractical valuations to preserve the founder’s ownership, or the founder must part with an uncomfortable share of their company by setting a realistic price.

Liquidity preferences add an additional dagger: if a company sells for less than the total amount of money raised, all capital must be returned to investors, often leaving founders and employees with nothing. This has happened in our industry in recent transactions and is something we must strive to avoid.

Facing this reality, we give the same advice to every political tech founder: stay disciplined, stay lean, and race to profitability. Our mission is to protect the progressive ecosystem from the whiplash of boom/bust that has doomed overly ambitious startups that chase new markets and artificial growth. Raise ‘Minimum Viable Capital’, not ‘Maximum Available Capital’.

Our Path Forward: Revenue Based Investing

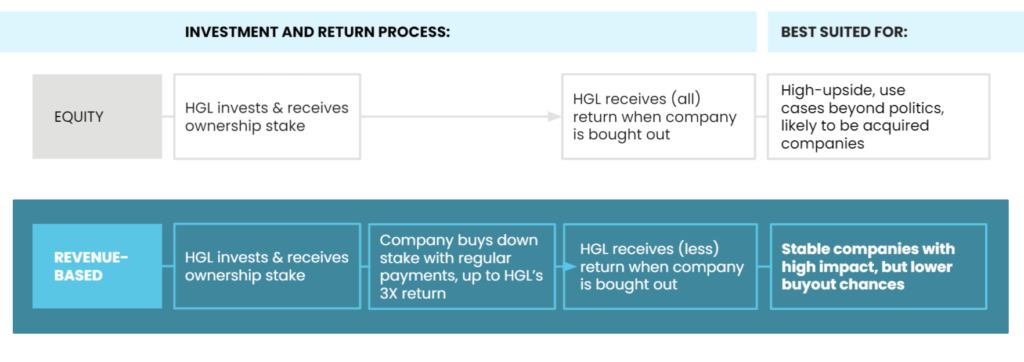

To align with the advice we share with our founders, Higher Ground Labs is introducing a new investment instrument: the Revenue Based Investment or “RBI”. The RBI is designed to provide founders with early growth capital, while presenting the rare opportunity to pay-back investors in real time; to regain control of their cap table and company.

The mechanics of the note are simple. Higher Ground Labs will provide a startup with an investment and assume an ownership in the company. After a 1-year “holiday” period, that company will send between 5–7% of their monthly recurring revenue to Higher Ground Labs until 3x the initial investment has been paid off. Each payment will reduce Higher Ground Labs’ ownership in the company proportionally. When Higher Ground Labs is fully returned in its investment, we are off the company’s cap table save for a 1% remaining position as “dummy insurance”. If the company chooses to raise a traditional venture capital round, Higher Ground Labs can convert into its pre-negotiated ownership or the founder can choose to buy back the equity stake.

This funding mechanism is a good fit for founders who want to preserve optionality and ownership in their sustainable, cash-flowing political tech startups. It is a bad fit for startups that require extended periods of R&D or operate in “winner take all” markets.

HGL will introduce this instrument in 2021 for all new investments to help align investors and founders on fair, believable terms. This instrument will generate returns for investors while also providing founders and employees with a path to meaningful ownership and freedom. We believe it is the future of political tech.